This letter was originally published in the Financial Times (subscription needed).

Sir, We were intrigued to read your report, “Draghi makes appeal for those left behind” (September 14, subscription needed), on the speech by Mario Draghi, president of the European Central Bank, urging the EU to “pay more attention” to redistribution and inequality.

While we applaud his appeal, we are surprised that he does not acknowledge the ECB’s own responsibility for the growing concern about redistribution and inequality in Europe and around the world.

His remarks suggest that it is only the flawed fiscal and structural policies of governments that are responsible for these problems. However, we know unconventional monetary policies implemented by the ECB and other central banks in rich countries have contributed to these developments. Quantitative easing, by raising asset prices, has disproportionately benefited the wealthy, thereby contributing to rising inequality.

In addition, central banks’ negative interest rate policies are discouraging saving, particularly by young people, which is exacerbating their sense of insecurity. Moreover these policies seem indifferent to the need for a more inclusive financial system that, for example, increases the availability of credit to small businesses and encourages banks to provide financial services more responsive to the needs of the poor and young people.

While the independence of central banks is important and must be respected, it does not mean they should be unaccountable and able to avoid responsibility for the adverse consequences of their actions.

It is accepted that financial institutions must exercise due diligence in assessing the likely impact of their proposed actions and try to mitigate the negative impacts they cause. There is no good reason why central banks should not be held to the same standards of conduct. It would therefore behove Mr Draghi to acknowledge his own institutional responsibility for dealing with inequality and redistribution in any future calls for EU action.

Motoko Aizawa

Managing Director US, Institute for Human Rights and Business,

London N1, UK

Daniel Bradlow

Professor of International Development Law and African Economic Relations,

University of Pretoria, South Africa

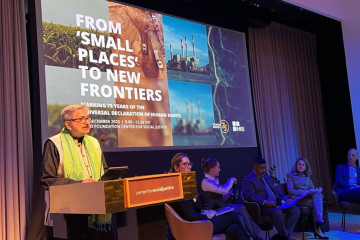

Image: Mario Draghi, President of the European Central Bank

Credit: Flickr/European Central Bank.

The perception of ‘value’ needs to change if the World Bank’s mission is to succeed

Last week we attended the Spring Meetings of the World Bank and International Monetary Fund (IMF) in Washington, D.C. The annual IMF-World Bank meetings bring together finance ministers and central bankers from all regions as a platform for official...

26 April 2024 | Commentary

Commentary by Vasuki Shastry, Author, ESG/Strategic Communications Expert; International Advisory Council, IHRB Haley St. Dennis, Head of Just Transitions, IHRB